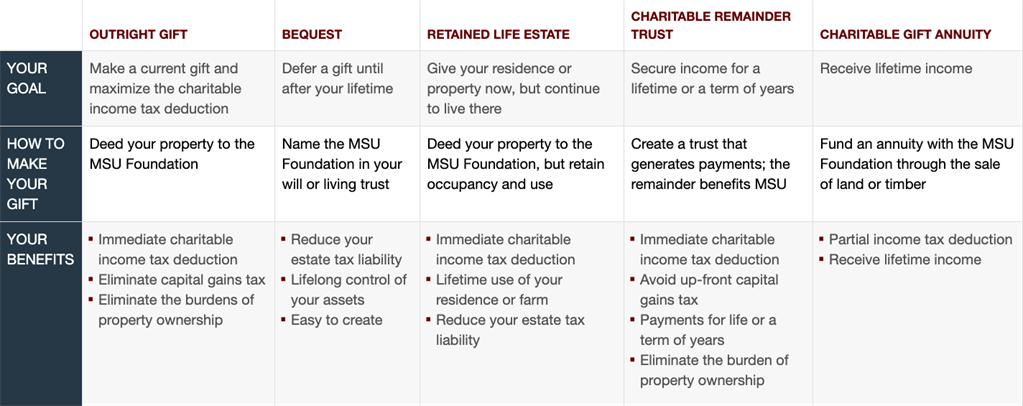

METHODS OF GIVING

A gift of timberland provides a unique opportunity to see your land preserved while benefiting MSU. | Many types of property can be considered for Bulldog Forest. | Real estate gifts benefit MSU students and enable the university to thrive. | Funds from real estate gifts are used to support the university programs that are of greatest interest to the donor.

Summary

For many of us, our property is very personal. We respect and care for it, and it provides for us. A gift of real estate to Mississippi State broadens that mutual care by including others who can benefit. Students, faculty and the very institution itself can all have their lives enhanced in meaningful ways by your charitable gift. It is a remarkable way to begin a legacy.

Outright Gift

CREATE A LEGACY, RECEIVE A TAX BENEFIT

When you make an outright gift of real property held for more than a year, you obtain an income tax charitable deduction equal to the property's full fair market value. This deduction lets you reduce the cost of making the gift and frees cash that otherwise would have been used to pay taxes.

By gifting the property to Mississippi State, you also avoid capital gains tax on the property's appreciation. Furthermore, the transfer isn't subject to the gift tax, and your gift reduces your taxable income.

Example: Mary gives the MSU Foundation a vacation property she no longer uses. It originally cost $50,000 but is now worth $150,000. She gets a $150,000 charitable deduction, which represents a tax savings of 42,000 in her 28 percent tax bracket. She completely avoids tax on the $100,000 of appreciation. Now, Mary no longer has to maintain the cottage, and the property won't be taxable in her estate.

Your deduction for a gift of appreciated real estate in any year is generally limited to 30 percent of your adjusted gross income (AGI), with a five-year carryover of the unused deduction. If you elect to base your charitable deduction on the cost of the property, this raises your AGI limitation to 50 percent with a five-year carryover and has implications for all gifts made during or carried over to that year.

For real estate that has been held only short term (a year or less), your charitable deduction is limited to the property's cost basis, but there is still no tax on the appreciation. The deduction may be claimed up to 50 percent of your adjusted gross income, with a five-year carryover for any excess value.

Your gift is usually effective when a properly executed deed (suitable for recording under state law) is delivered to the MSU Foundation. The amount of your deduction for a gift of real estate (if more than $5,000) must be substantiated by a qualified appraisal of its fair market value.

Bequest

GIVING REAL ESTATE THROUGH YOUR WILL

If making an irrevocable lifetime gift of property through one of the other options discussed does not meet your needs, consider giving it in your will. Because your will is revocable (that is, you can change your mind at any time), you will not be able to take an income tax deduction, but the property will not be taxed as part of your estate. Through your will, you may also give another person lifetime use before unrestricted ownership passes to Mississippi State. You may also bequeath full title to an individual if that person survives you with Mississippi State as the contingent recipient.

If you don't need to make a new will now for any other reason, ask your attorney to draw up a brief codicil for this purpose. A codicil is an easily prepared and inexpensive supplement or additional provision. We encourage you to notify the MSU Foundation if you plan to make a gift in your will.

Retained Life Estate

GIVE YOUR HOME, BUT ENJOY LIFETIME USE

Let's assume you like the tax advantages a charitable gift of real estate would offer, but want to continue living in your personal residence for your lifetime. You would like to retain the right to rent your house or make improvements. You may also want a survivor (perhaps your spouse) to enjoy life occupancy, but ultimately, you would like Mississippi State to receive the property.

By deeding your home to us now, subject to all these rights, you can still obtain valuable tax savings. This arrangement is called a retained life estate. Even though the MSU Foundation would not take possession of the residence until after the lifetimes of the tenants you've named, you receive an immediate income tax charitable deduction because the gift cannot be revoked. The amount of the deduction depends upon the value of the property, your age and the age of any other person given lifetime use of the property.

Example: Greg, age 70, and his wife, Amanda, age 69, give the MSU Foundation the remainder interest in their home, which is currently worth $200,000. They retain a life estate for their lifetimes. After both have passed away, the MSU Foundation receives the home. Greg and Amanda are eligible for an income tax deduction of $68,848 in the year they establish the life estate. Plus, this gift removes the full $200,000 value from their federal estate.

With this kind of gift, you retain all the rights and responsibilities of ownership such as maintenance, taxes, improvements and insurance – other than disposing of the property after your death. In other words, you may continue to live as you have with no interference. You may even decide to move out temporarily or permanently. Should you rent your home, all of the rent belongs to you.

Charitable Remainder Trust

OBTAIN A LIFE INCOME FROM YOUR GIFT

Instead of making an outright gift of real property or establishing a retained life estate, you can use unmortgaged property to fund a qualified charitable remainder trust. Once the property has been transferred to the trust, the trustee can then sell it and invest the proceeds in income-producing securities. These investments can provide income payments to you and any other recipient you name for either a lifetime or term of years. When the trust terminates, Mississippi State will receive the remainder in the trust. This strategy avoids estate taxes when spouses are the only income beneficiaries.

You can also benefit from a substantial current income tax deduction. The amount of the deduction is determined by the age of the income beneficiaries when the trust is created, the value of the trust assets and the annual percentage or amount to be paid to the income beneficiaries. When you transfer appreciated property, you will not pay any tax on the capital gain.

Example: Sam and Mary, both age 75, establish a charitable remainder trust with real property worth $250,000. The trustee sells the land, invests the proceeds and pays Sam and Mary 5 percent of the trust's value whether the value increases or decreases. They are eligible for an immediate income tax deduction of $124,948; plus the home's value is removed from their taxable income.

Creating a Charitable Gift Annuity

MAKE YOUR LAND OR TIMBER WORK FOR YOU

To create a charitable gift annuity through a gift of land or timber, the donor transfers assets to the MSU Foundation in exchange for a contract to pay him or her, and/or another beneficiary. The donor receives an immediate income tax deduction and may receive a portion of each annuity payment free of income tax.